Money travels fast in 2025. You can buy shoes and pay in four installments. You can get a loan from a ride-hailing app. You can send money across the world in seconds without visiting a bank.

This is the power of fintech and embedded finance.

These two buzzwords are changing how we handle money. But what exactly do they mean? And why should small business owners care?

In this guide, we’ll define fintech and embedded finance in simple terms. You’ll learn how these tools can supercharge your business, what dangers to watch out for, and what’s coming down the pike.

Let’s dive in.

What is Fintech?

Fintech stands for “financial technology.” It’s any tech that makes money easier, faster, or more convenient to manage.

Examples include:

- PayPal – Send money online without cash

- Venmo – Split the bill with friends right away

- Robinhood – Buy and sell stocks on your phone

- Stripe – Accept card payments on websites

Fintech companies use apps, software, and smart systems to replace old banking methods. No more lines at the bank. No more paper checks. It’s all done on your phone or computer.

The goal? Make money easier for the world.

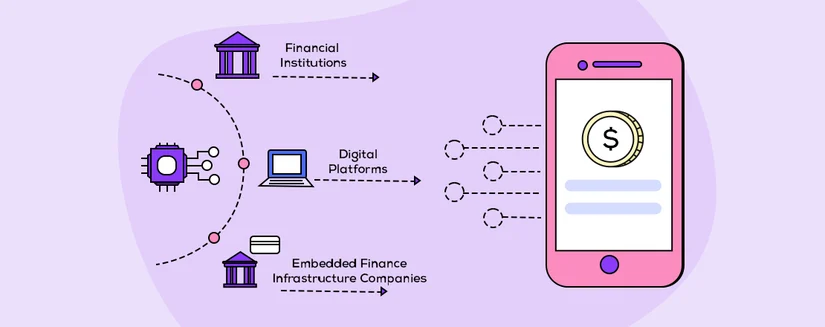

What is Embedded Finance?

Embedded finance is the future of fintech.

It means integrating financial services into non-financial apps or platforms. You don’t visit a separate bank or payment app—the service is built right into what you’re already using.

Examples:

- Uber – Drivers get instant payouts through the app

- Shopify – Shop owners get business loans through their dashboard

- Amazon – Buy now, pay later financing at checkout

- Tesla – Finance your car purchase directly on their website

That’s embedded finance: behind the scenes, but powerful.

Why Embedded Finance is Exploding in 2025

Embedded finance is booming because:

- Convenience wins – Everything in one place, no app-switching.

- Mobile-first world – Everyone shops and pays on their phones.

- Better data – Companies know their customers and can offer tailored financial products.

- APIs make it easy – Tech firms can add financial features without becoming banks.

- Built-in trust – Customers already trust the brands they use.

By 2025, embedded finance will handle trillions in transactions worldwide.

Benefits Of Fintech and Embedded Finance

- Faster Payments – Accept cards, wallets, and international payments in real time.

- Easy Access to Loans – Get loans directly via your payment platform, with fast decisions.

- Better Customer Experience – Offer BNPL (Buy Now, Pay Later) to boost sales and loyalty.

- Lower Costs – Avoid high bank fees with cheaper, transparent fintech solutions.

- Easy Accounting – Sync transactions with accounting software automatically.

- Reach More Customers – Accept global payments in multiple currencies.

Risks and Challenges

- Regulation Confusion – Rules differ by country; non-compliance can be costly.

- Data Security Concerns – Handling sensitive financial data means higher risk.

- Technology Dependence – Outages or policy changes at providers can disrupt business.

- Hidden Costs – Some fintech platforms add surprise fees.

- Customer Support Issues – Not all providers offer responsive support.

Future Trends in Fintech and Embedded Finance

- AI-Powered Finance – Smart systems will predict cash flow and automate decisions.

- Blockchain & Crypto – Faster, cheaper, and safer transactions with wider crypto adoption.

- Super Apps – One app to shop, bank, invest, and insure.

- Personalized Banking – Tailored loans, payment terms, and advice for businesses.

- Cross-Border Growth – Easier global sales, local currency payments, and automatic tax handling.

Fintech and embedded finance are reshaping business forever.

Small businesses now have access to tools that once only big enterprises could use—global payments, instant loans, and flexible customer options.

The future is here. The real question: Will you use these tools to grow your business?

Start exploring fintech platforms today. Try a payment processor with embedded features, experiment with Buy Now, Pay Later, and watch your sales grow.

The businesses adopting fintech today will become tomorrow’s industry leaders.

Want to level up? Put one fintech tool in place this week and see the difference.